OPEC Cautions West Against Biofuels

While the price of oil sits at nearly a nine-month high, the Organization of the Petroleum Exporting Countries (opec) has warned the West that the development of biofuels could further drive up the price of oil. If opec makes good on its word, it will increase American inflationary pressure and depress America’s consumer economy.

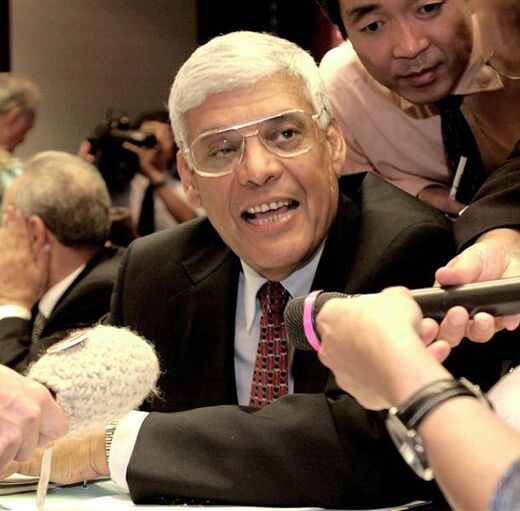

Abdalla Salem El-Badri, secretary general of opec (which controls about 40 percent of global oil production), revealed the organization’s displeasure over the ongoing development of alternative fuels. He warned that, as a protective measure, opec is considering cutting its investment in new oil production. “If we are unable to see a security of demand,” he stated, “we may revisit investment in the long-term.”

For the West, reducing its dependence on foreign sources of energy is a meaningful step toward reclaiming greater autonomy over its economic destiny. But according to El-Badri, this goal among Western nations has cast a shadow on opec’s half-trillion-dollar production infrastructure investment plans. If America, for example, followed through on its pledge to reduce its oil consumption by 20 percent within the next decade via biofuels and more efficient engines, the reduction of oil demand would pinch opec’s profits and reduce its influence over Western economies.

This warning from opec clearly highlights the dangers associated with relying on unstable and hostile regimes for energy supply. The goal of energy independence is terribly important—but the trouble is, it is unrealistic in the short term. Western dependence on opec oil is deep and significant—and will remain so for the forseeable future no matter how hard these nations work to find alternative sources.

Naturally, opec nations need to keep cash flowing in, and thus must remain reasonably competitive in providing global oil supply, but with oil prices already at high levels, there isn’t much wiggle room before reduced supplies would start to make oil-importing nations very uncomfortable. Considering the enormous and growing demand for oil in the world today, the prospect of opec reducing investment presents a serious quandary.

Already today, opec can increase or decrease oil production, which can dramatically affect oil prices. Because of America’s acute dependence on oil imports, any increase in oil prices hampers economic productivity at home—creating inflationary pressure.

This most recent warning should serve as a grim reminder of opec’s power. As this energy cartel works to siphon off as much profit as possible before Western nations find their alternative sources of energy supply, we may witness a significant short-term effect on these economies, particularly America’s. Sustained inflationary pressure on the U.S. could take a devastating toll on America’s consumer-based economy.