Britain: Millions Rely on Short-Term Credit to Pay Mortgage

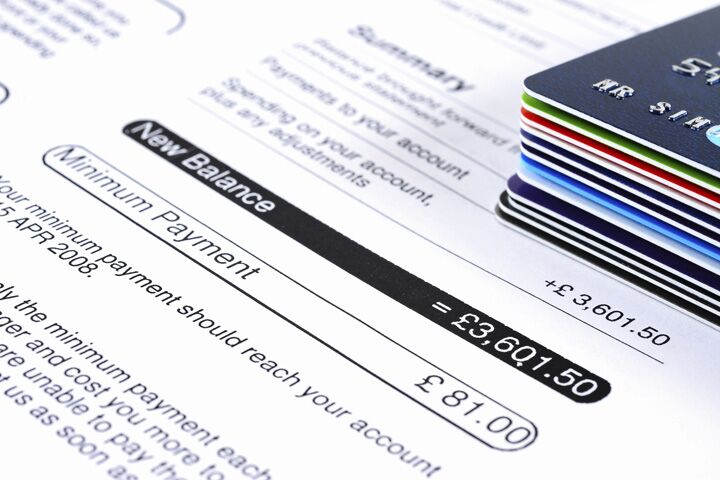

The number of British entering economic hardship is growing—fast. Worse still, few have the financial smarts to manage, let alone solve their economic woes. Last week, Times Online reported that more than 4 million British households have taken out a personal loan or credit card to make mortgage or rental payments in the past year.

“It’s a very serious situation when you have people turning to a short-term solution to fund a long-term product,” said Tim Moss, head of loans and debt at MoneySupermarket.com. It’s guaranteeing that you’ll pay even more on debts you don’t have enough money to pay in the first place.

Paying a mortgage payment using a credit card that charges interest of over 15 percent is not the proverbial finger in the dike. It’s a stick of dynamite wedged into it. While it might slow the seep of water, for a short while, it’s guaranteed to puncture a bigger hole, exacerbating the damage. Credit card mortgage payments make the looming flood all the more inevitable.

It’s not just young homeowners who are relying on high-interest borrowing to pay the mortgage or rent. “[T]wenty percent of people in their 40s have turned to loans or credit cards to keep their heads above water, says MoneySupermarket.com” (Times Online, July 3).

With food and energy prices rising and a number of economies tottering, financial trials are becoming a reality for growing numbers of people around the world, especially for people in Britain and America, where enjoying a high standard of living is an expectation rather than a luxury. Sadly, however, our demand for a high standard of living has us hooked on debt.

That more than 4 million households are taking on higher-risk, shorter-term debt to pay the mortgage or rent reveals how ingrained acquiring debt has become in Britain. We know the culture of debt is out of control when it begins to defy logic: Too many people believe the solution to their debt problem is taking on more debt!

There is another way out of financial trial. It will require hard work, discipline, willingness to sacrifice and a certain element of faith. If you’re in a financial hard spot—and if you are, you’re definitely not alone—resist the go-with-the-flow urge to borrow your way out.

Instead, make it a goal to devise a financial strategy by which, in time and with dedication and discipline, you can work your way back to financial solvency. TheTrumpet.com can help you prepare this financial strategy. You can begin by reading “Storm-Proof Your Financial House,” “Be a Good Steward,” “The Man Who Couldn’t Afford to Tithe” and The Seven Laws of Success.