Xi in a Tempest, Putin in the Sunshine?

Xi in a Tempest, Putin in the Sunshine?

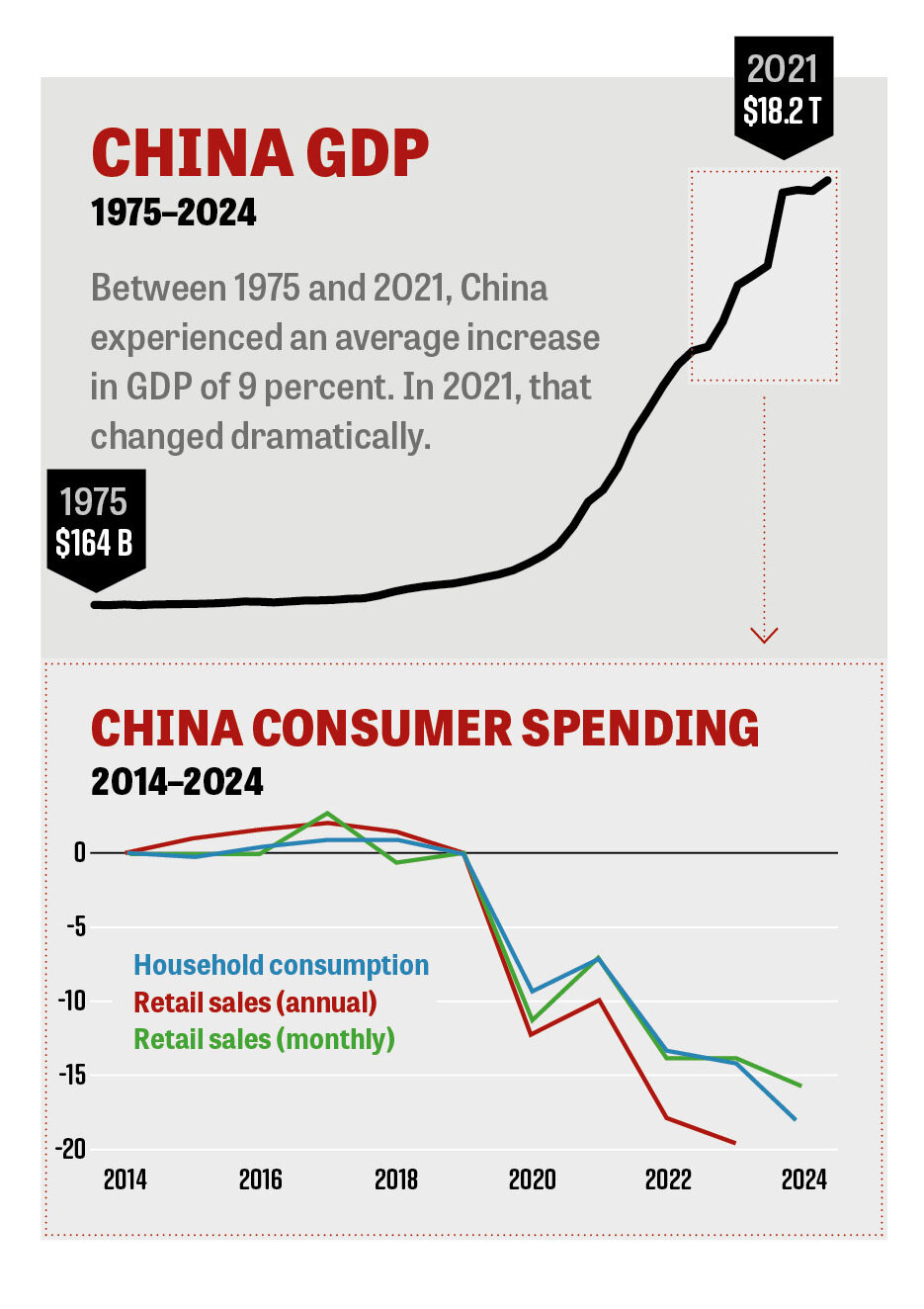

For decades the sun shone full strength on China’s economy. As it rose from Maoist poverty to become the world’s manufacturing hub, with a rapidly growing workforce and soaring productivity, its growth was unparalleled by any nation in modern history. From the 1980s to the mid-2010s, China averaged a radiant 9 percent growth in gross domestic product per year.

The nation seemed unstoppable. It looked like the dawning of the “Chinese Century.”

But in the mid and late 2010s, it became clear that the weather was changing. The one-child policy that Chinese Communist Party planners had implemented in the 1970s to curb population growth was shrinking the workforce and aging the population. Also darkening the skies were a cooling real estate market, mounting debt, overcapacity in heavy industry, soaring youth unemployment, low domestic consumption and trade friction with the United States.

It was plain that China’s economic summertime was over.

Darkening Skies

The government reacted in 2016 by reversing the one-child policy. But this came decades too late to reverse the demographic crisis, and by then, few citizens took them up on the offer. Chinese couples continued to have fewer children than needed for population replacement, and the nation’s workforce kept shrinking.

Then in late 2019, with conditions already ominous, China unleashed covid on the world. The ccp reacted with lockdowns on its people so draconian and prolonged they made Western restrictions look leisurely.

The open tyranny traumatized the Chinese people and began awakening much of the rest of the world to the ineptitude and despotism of the Chinese government. Domestic consumption and foreign investment continued to decrease, further darkening the economic clouds.

At the same time, years of speculative overbuilding, staggering developer debt, tightening credit policies and collapsing consumer confidence were catching up to the real estate market. Soon what had been a cooling property sector essentially froze over.

The storm broke, causing a flood of defaults among public developers. And since real estate had been the primary trade wind of Chinese growth and the single-largest store of the nation’s household wealth, the storm raged far beyond construction sites. “This is just like the U.S. financial crisis on steroids,” famed hedge fund manager Kyle Bass told cnbc. “… The basic architecture of the Chinese economy is broken” (Feb. 5, 2024).

The storm surge battered banking, asset management, local government finance and the industrial sector. Suddenly, analysts and investors across the country and around the world doubted the durability of China’s economic model.

Hope for Sunshine?

In December 2022, China finally ended its catastrophic “zero-covid” measures. This was woefully belated, coming some 18 months after almost all other nations had ended their restrictions. But experts had a “better late than never” attitude and forecast that reopening the Chinese economy would bring the sunny skies back.

Instead, the opposite happened.

“China’s economy is in serious trouble,” Paul Krugman wrote in the Jan. 20, 2024, New York Times, adding that the nation was “entering an era of stagnation and disappointment.”

He pointed out that even official ccp statistics, which officials routinely massage to give an appearance of economic vitality, couldn’t hide the fact that China was suffering chronically weak domestic consumption, deflation and soaring youth unemployment. Almost every other indicator measurable by outside economists confirmed that the nation was still woefully underperforming.

Part of the reason for the persistent economic gloom, Krugman argued, was the nation’s supreme leader: “President Xi Jinping is starting to look like a poor economic manager, whose propensity for arbitrary interventions—which is something autocrats tend to do—has stifled private initiative.”

As tax revenues continued to slump, Xi’s government attempted to weather the storm by doubling down on credit expansion. Soon its debt ballooned to levels that exceed even those of the profoundly profligate United States—and most every other nation. Today, China’s total debt is more than 300 percent of its gross domestic product. This is up from 200 percent only a decade ago, with no indication that it will stabilize.

Chinese citizens reacted to the economic headwinds by further slashing their consumption, which exacerbated the storm. Pessimism became entrenched. By mid-2025, so few were taking out mortgages or any other type of credit that China’s banks reported a decline in yuan loans for the first time in 20 years. The government seemed to panic and announced a new policy on August 12 to subsidize loans to householders and businesses.

Economists said the unprecedented measure could make a difference but that it was unlikely to be significant. “Overall, Chinese consumption is not very heavily credit fueled, as Chinese households tend to have a rather high savings rate,” Lynn Song, chief China economist at ing, told the Financial Times. “Unlocking these savings by restoring confidence would likely be a bigger game changer, but that is obviously a lot harder to do” (August 13).

King Over the ‘Kings of the East’

The subsidy could block some of the short-term economic damage. But China’s fundamental structural problems remain unresolved: The workforce keeps shrinking, housing demand keeps dropping, consumer sentiment keeps darkening, foreign direct investment keeps declining and debt keeps growing. This means that even if China doesn’t descend into a full-blown economic typhoon, the economy and its controller, Xi Jinping, are still growing measurably weaker.

This is significant because the Trumpet has been anticipating a reduction in the power of China’s strongman relative to his counterpart in Russia.

Bible prophecy speaks of a huge end-time Asian military force called “the kings of the east” (Revelation 16:12). Ezekiel 38:2 reveals that the leadership of this Asian group will be headed by “the prince of Rosh, Meshech, and Tubal” (New King James Version). Meshech and Tubal are ancient names corresponding to modern Russian cities, and Rosh is a variation of an early name for Russia. This “prince” is clearly a Russian leader.

The verse says “the land of Magog,” which includes modern China, will be a crucial member of this alliance. But the phrasing makes plain the leader of this “kings of the east” power bloc will not be Chinese but rather Russian.

Trumpet editor in chief Gerald Flurry has identified Russia’s president as the man who will fulfill this role. “We need to watch Vladimir Putin closely,” Mr. Flurry writes. “He is the ‘prince of Rosh’ whom God inspired Ezekiel to write about 2,500 years ago!” (The Prophesied ‘Prince of Russia’).

The next weather front moving in on the Chinese economy could determine how soon and to what degree the power of Xi Jinping and China will decline. Meanwhile, 3½ years into its war on Ukraine and despite geopolitical tensions and international sanctions, Russia’s economy is showing remarkable resilience. Real wages are rising significantly, unemployment is at historic lows, India is working more closely with Russia, and somehow the sun is always shining on President Putin. The power balance in the Russia-China axis is shifting in accordance with Bible prophecy.