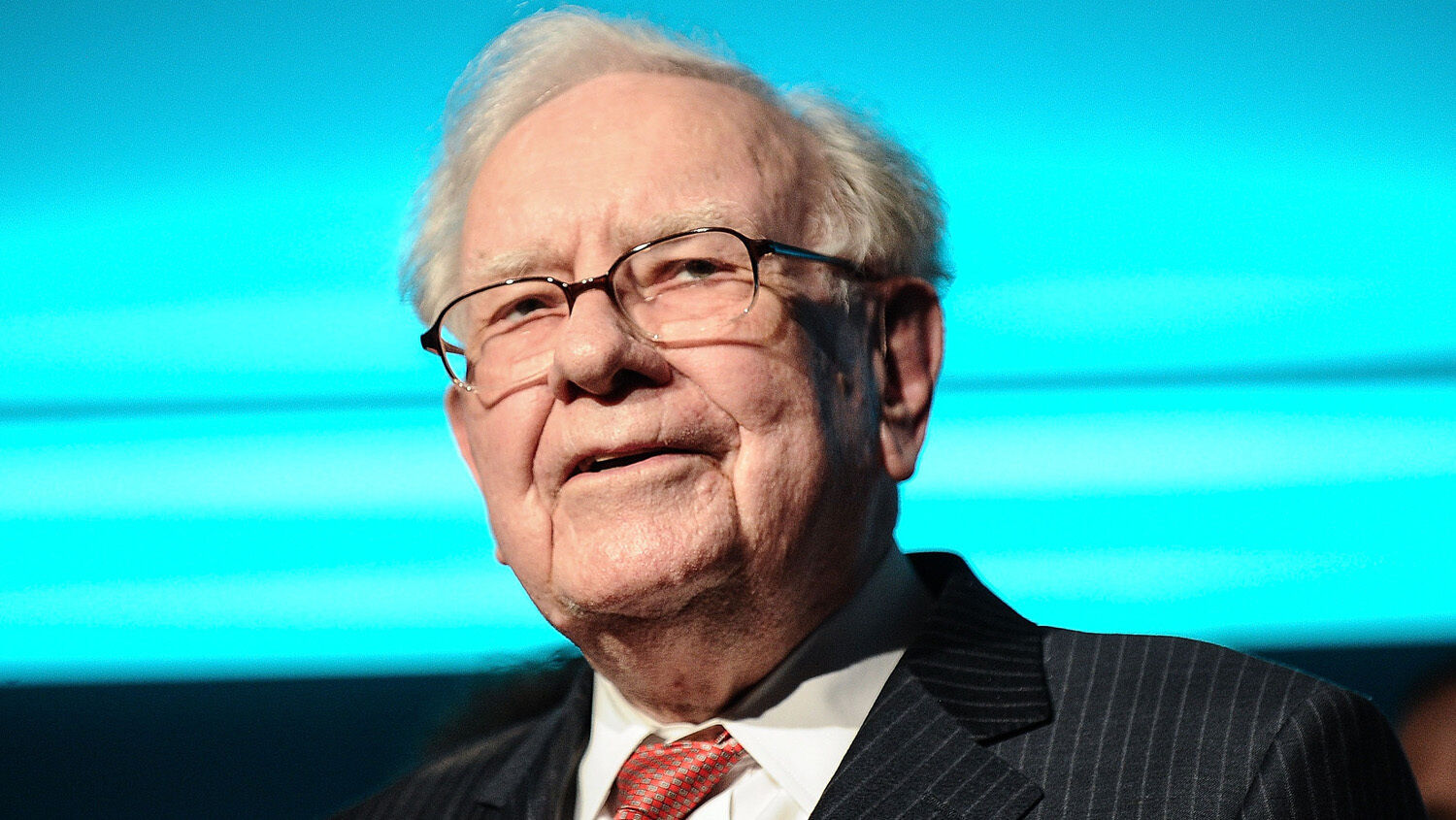

Warren Buffett’s Warning to America

Warren Buffett is an American icon. Often called the “Oracle of Omaha” for his folksy Nebraska lifestyle and his near-prophetic ability to pick winning investments, Buffett got his start as a stock trader when he was only 11 years old. Back in 1942, while the Nazis were rampaging across Europe, the young son of Rep. Howard Buffett sold chewing gum, Coca-Cola and weekly magazines door-to-door.

He used his hard-earned cash to invest in America.

As a teenager, Buffett did his best to pick which stocks would go up in price until he read a book by Benjamin Graham. Nineteen-year-old Warren learned to stop trying to predict the ups and downs of the market and to try instead to ascertain the intrinsic value of the companies he was buying.

Buffett became a millionaire by age 32 and a billionaire by age 56. Today, at 94, Buffett is the sixth-richest person, with a net worth of $168 billion. He would have been the richest man in the world if he hadn’t given away roughly $58 billion to charity. He still lives in a modest house in Omaha and only buys his favorite Cherry Coke when it’s on sale.

Now, 83 years after his first stock trade, the world’s most successful investor is retiring. On May 5, Buffett announced that he will be stepping down as the chief executive of his Berkshire Hathaway investment company by the end of the year. He will hand over the reins to vice chairman Greg Abel. The Oracle of Omaha assured investors that he is confident his company is in good hands, but he is far less optimistic about the future of the United States.

In a shareholders’ address on May 3, Buffett emphasized concern over America’s 7.3 percent budget deficit.

“We’re operating at a fiscal deficit now that is unsustainable over a very long period of time,” he said. “We don’t know whether that means two years or 20 years, because there’s never been a country like the United States, but you know, if something can’t go on forever it will end, to quote Herb Stein, the famous economist.”

This warning should get people’s attention.

Buffett has made an unparalleled career out of ignoring media hype and focusing on underlying fundamentals. His motto is, “It is far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Yet when he looks at the underlying fundamentals of the U.S. government, he sees an unsustainable business model.

“I wouldn’t want the job of trying to correct what’s going on with the revenue and expenditures of the United States with roughly a 7 percent gap when probably a 3 percent gap is sustainable,” he continued. “The further you drift from that, the closer you get to the point where the uncontrollable begins. It’s a job I don’t want.”

You can’t argue with Buffett’s math.

The U.S.’s average annual real gross domestic product growth rate has hovered around 2 percent over the past two decades. Any deficit above 2 percent increases America’s debt-to-gdp ratio. There is a lot of debate over how high the debt-to-gdp ratio can get before the U.S. collapses. But like Buffett said, “If something can’t go on forever, it will end.”

Even the Oracle of Omaha cannot predict exactly when the U.S. will collapse. He says it could be as soon as two years or as far away as 20 years. But collapse is coming unless Congress starts balancing the budget.

In many ways, Buffett’s warning is similar to a warning that statistician Roger Babson delivered to an Association of Commerce luncheon in January 1920. According to the late Herbert W. Armstrong, who attended this luncheon, Babson forecast “the worst business depression that our generation has ever experienced.”

By the end of the year, Babson was proved right: The recession of 1920–1921 hit. How did he know?

“If I want to know what the temperature is, now, in this room, I go to the wall and look at the thermometer,” Babson explained to those wondering how he could predict the future. “If I want to know what it has been, up to now, and the existing trend as of the moment, I look at a recording thermometer. But if I want to know what the temperature in this room is going to be an hour from now, I go to the source which determines future temperatures—I go down to the boiler room and see what is happening down there. You gentlemen looked at bank clearings, indexes of business activity, stock car loadings, stock-market quotations—you looked at the thermometers on the wall; I looked at the way people as a whole were dealing with one another. I looked to the source which determines future conditions. I have found that that source may be defined in terms of ‘righteousness.’ When 51 percent or more of the whole people are reasonably ‘righteous’ in their dealings with one another, we are heading into increasing prosperity. When 51 percent of the people become ‘unrighteous’ in their business dealings with their fellows, then we are headed for bad times economically!”

Buffett does not talk about “righteousness” as overtly as Babson did, but he is telling Berkshire Hathaway shareholders to ignore the thermometers and look at underlying fundamentals, just as he has done over the decades. Buffett said in 1991, “I’ve seen more people fail because of liquor and leverage—leverage being borrowed money. You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.”

Yet America’s leaders do not want to listen to wealth producers like Warren Buffett. They want to throw caution to the wind and borrow as much money as they can. The Bible foretells this will end badly.

In Deuteronomy 28:44-45, God says that nations that reject His law borrow from foreigners, but do not lend to them. When you borrow and do not lend, you end up in debt. And in America’s case, God says debt will be one of many curses that “shall come upon thee, and shall pursue thee, and overtake thee, till thou be destroyed.”

To learn more, read “The Biggest Threat to America’s National Security.”