Breakdown: Biden’s 2024 Budget Proposal

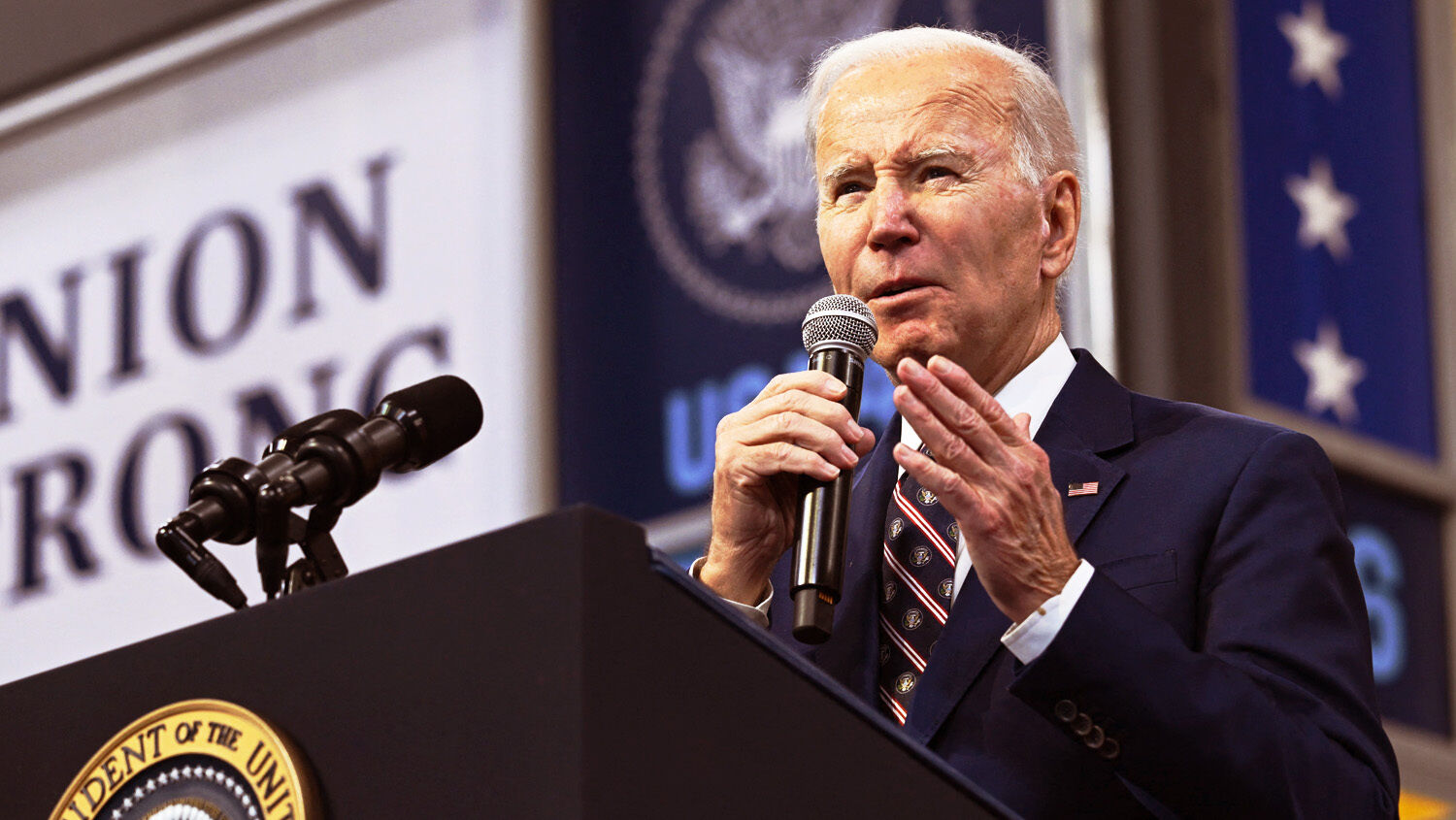

On March 9, United States President Joe Biden released his budget proposal for the 2024 fiscal year, which was due in February. It focuses on increasing taxes, spending and borrowing.

Changes to taxes: The proposal adds up to $4.7 trillion in tax increases alone. The majority of these increases target the wealthy, corporations and energy companies. Some of the changes include:

The wealthy:

- $437 billion from “a minimum income tax on the wealthiest taxpayers”

- $23 billion from higher taxes on the retirement plans of “high-income taxpayers”

- $235 billion from increasing the top marginal rate for high-income earners

Corporations:

- $238 billion from increasing the tax on stock buybacks

- Companies buy back stocks to consolidate ownership and increase earnings per share, which attracts investors. A higher tax would discourage companies from doing this, hurting the stock market.

- $214 billion from higher taxes on capital gains

- This discourages investments and the sale of property.

- $1.3 trillion from increasing the corporate tax rate from 21 percent to 28 percent and $200 billion from other “reforms” to business taxation

- Companies will look for ways to cut spending elsewhere to afford the tax increase. That could lead to raising prices, hurting the consumer and increasing inflation. Downsizing is another way to cut spending, which would raise the unemployment rate.

Energy:

- $103 billion from “reform[ing] taxation of foreign fossil fuel income” and “modify[ing] energy taxes”

- This is hidden under the guise of helping the environment. In reality, it would discourage energy exploration. The need for fuel remains the same regardless of an increased tax, meaning a spike in gas prices.

Medicaid:

- $306 billion from applying Medicare taxes to pass-through income

- Biden himself avoided paying Medicare taxes before taking office and may owe the Internal Revenue Service up to $500,000 in back taxes.

- $344 billion from increasing the rate of Medicare tax from 3.8 percent to 5 percent for those with a $400,000 annual income

Changes to borrowing: The idea behind raising taxes is to be able to afford expenditures so borrowing is unnecessary. Under Biden’s plan, the taxation is still not enough to fund his new programs, many of which offer subsidies for educational institutions, child-care services and insurance companies. In theory, the budget would make these services more affordable. In reality, it encourages the companies to raise their prices because the government has agreed to pay the rest.

The proposal would start with borrowing $1.5 trillion per year. This would climb to $2 trillion after a decade. By the end of 2029, just the interest payment on America’s national debt would be $1 trillion.

Will it pass? With a Republican-controlled House, the proposed budget is unlikely to pass. However, it is still worth looking into to see the dangerous ideology of the left. Mankind is incapable of solving its problems, as this budget proposal exposes.

Learn more: America’s spending and borrowing habits raise the question: What happens when the U.S. runs out of other people’s money? For the answer, listen to “The Obama Budget: Run Up the Debt and Redistribute Wealth.”