Get Ready for More Bank Failures

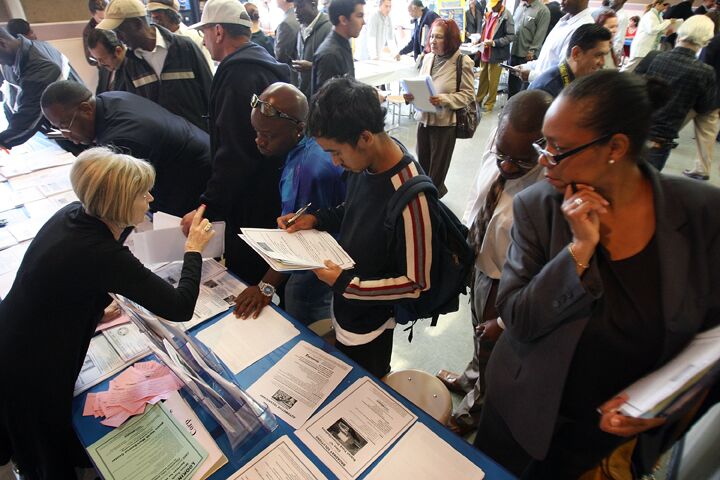

Employers chopped 345,000 jobs in the United States in May. The losses were far less than expected, but that is little comfort for a banking sector struggling to stay solvent. The national unemployment rate has now reached the critical zone and some analysts are wondering if round two of the banking crisis is on the way.

On June 5, the Bureau of Labor Statistics surprised analysts with an employment report that showed fewer job losses than expected and far less than the over 500,000 jobs lost in April. But that is where the good news ends.

America’s unemployment picture is now worse than the current administration had anticipated just a few months ago. U.S. unemployment stands at 9.4 percent, the highest in more than 25 years.

May’s better-than-expected numbers have led some analysts to predict that the economy is now headed back to normal. But don’t be fooled. The economy isn’t close to back to the good old days yet. In fact, round two of the banking crisis may be on its way.

Remember the government’s so-called bank stress tests? Here is what the Trumpet wrote about the much-hyped “stress test,” which revealed that a few banks needed to raise some money, but by and large all were just fine:

Unfortunately, the “stress test” wasn’t that stressful. It would have been a shock if any bank received a failing grade, since the government has made it its business and risked trillions to prevent those banks from failing.

“[T]he regulators didn’t have the resources to make a really careful assessment of the banks’ assets, and in any case they allowed the banks to bargain over what the results would say,” confirmed Paul Krugman in the New York Times. “A rigorous audit it wasn’t” (emphasis mine).

But now the enthusiasm over passing the government test has worn off, the banks are facing a different scorekeeper: hard, cold reality.

Reality number one is that the national employment rate just blew through the government’s worst-case scenario rate of 8.9 percent for this year. Reality number two is that the job losses are probably not close to over yet. And reality number three is that taxpayers are far less likely to hand out bailout money so liberally again.

For banks, this means tough times could be ahead. Thirty-seven banks have failed so far this year. That compares to an average of less than four failures per year between 2000 and 2007.

As unemployment rises, house prices tend to fall, while the number of mortgage defaults increase. Additionally, higher unemployment leads to less consumer spending, which can affect business loans and commercial property valuations and mortgages. As long as the economy continues to deteriorate and jobs are lost, bank balance sheets will come under pressure.

It appears that the government may be preparing for more failures too, including a “big bank failure,” according to Fortune. On May 20, President Barack Obama signed into law a bill allowing the Federal Deposit Insurance Corp. to borrow as much as $500 billion from the Treasury Department to protect the deposits of bank customers. This amount is approximately one quarter of all the taxes expected to be collected for the 2009 budget year.

Like it or not, America is entering uncharted territory. The banking sector is the heart and core of America’s economy. It contains the pillars supporting the entire Anglo-Saxon economic model. The outlook is grim.

But there is hope. A new economy will emerge once all the greed, speculation, and unsupportable debt have been wiped out. For a glimpse at that future, read The Wonderful World Tomorrow—What It Will Be Like.