Russia, Algeria, Talk of a Gas Cartel

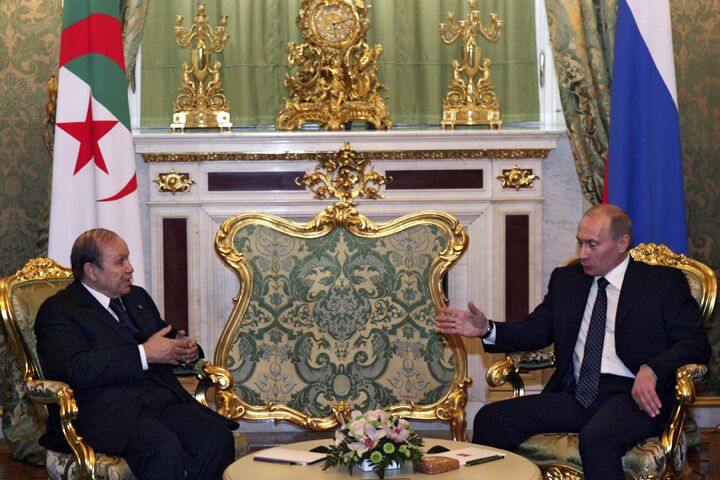

The presidents of Russia and Algeria met in Moscow this week. One major item on the agenda was the formation of a gas cartel along similar lines to opec.

“Algeria is the world’s fourth country in terms of natural gas export—Russia is also among major exporters,” said Russian President Vladimir Putin during the talks. “It’s extremely important that we keep in touch on energy issues, particularly since Algeria this year is chairing opec.”

“It’s clear that countries such as Russia, Qatar and Algeria already play a major role on international gas markets and they should coordinate their activities even more,” Algerian President Abdelaziz Bouteflika told reporters.

Oil has been a major weapon in Russia’s post-Cold War arsenal. Russia has not been shy about using oil to impose its will on those depending on it—witness Ukraine in January 2006 and Belarus a year later.

Europe was particularly spooked by the Ukrainian incident, where Russia temporarily cut off Ukraine’s gas. Eighty percent of Europe’s gas travels through Ukraine. Since that incident, Europe has been trying especially hard to wean itself off Russian energy.

Russia, of course, has tried just as hard to keep Europe addicted.

This has led to some interesting energy politics around the world. In the Caucasus, for example, both Europe and Russia have sought to develop key routes that would transport oil from Central Asia to Europe. With Georgian President Mikheil Saakashvili increasingly bowing the knee to the Kremlin, and the Russians’ recent progress in organizing new pipelines, it seems that here Russia is gaining the upper hand.

Algeria is another place that Europe has sought to diversify into. The Medgas pipeline, linking Algeria to Spain, and the Galsi pipeline, connecting Algeria to Italy, are both under construction.

Currently, Algeria supplies 10 percent of Europe’s gas. Russia provides 25 percent. So the two countries combined control just over a third of Europe’s gas imports. That would be enough to control the price, bearing in mind opec controls only 40 percent of the world’s oil resources.

Stratfor and Oxford Analytica, both highly reputable intelligence providers, say that a global gas cartel along similar lines to opec could not work. Oil is far easier to transport than gas. If a large oil producer in the Middle East decides to cut output, it affects prices around the world. In contrast, if a gas producer in Canada decides to cut output, only North America suffers. The vast majority of the world’s gas is transported via pipelines, so the destination cannot be changed at short notice.

However, Stratfor points out that the situation with the European market is different. In this case, a few suppliers are linked to one market by existing pipelines. Russia and Algeria control a major segment of that market. Although the rest of the world would be unaffected, this cartel could really put the squeeze on Europe.

By developing this cartel, Russia would make it hard for Europe to squirm out of the Kremlin’s grip.

This scenario may force Europe to be more aggressive in searching for gas elsewhere. It may now fight harder for control of the Caucasus, to gain access to Central Asian gas. Both Egypt and Iran have also offered to supply Europe.

Europe is well aware of Russia’s moves, and is attempting to forge an EU-wide common energy policy. Although little progress has been made so far, if Russia and Algeria do form a cartel, this could give Europe the motivation it needs to form a united energy policy.

Currently, Europe’s energy market is fractured and divided. Each individual state deals with Russia separately. The European Union cannot hope to stand up to the Kremlin this way.

Watch for the EU to make progress in uniting its energy market as it seeks to present a united front to an expansive Russia. Read “Russia: Triggering Europe to Unite” for more on how the threat of Russia will help trigger the unification of Europe.