OPEC Officials Worried About Dollar

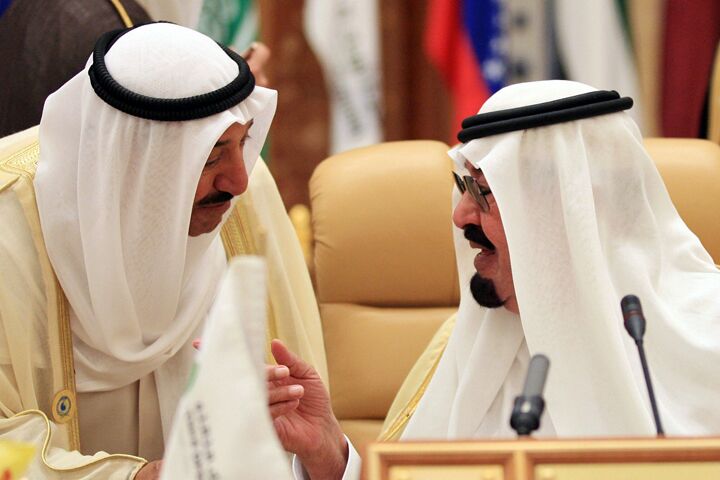

The Organization of Petroleum Exporting Countries met in Riyadh over the weekend, defending the high price of oil and, behind closed doors, expressing deep concern over the weak dollar.

Oil hovered near $100 a barrel heading into the summit, and the United States was pressuring the organization to increase production in order to lower prices. The appeal was ignored, as host country Saudi Arabia focused the meeting instead on long-term strategies, leaving production and pricing decisions for the organization’s regular December 5 meeting.

Venezuelan President Hugo Chavez declared that $100 a barrel was “fair,” tacking on comments that opec should be a “geopolitical actor” rather than an economic bloc, and that prices could reach $150 or $200 if the U.S. attacked Iran (Financial Times, November 18).

Tehran reiterated that $100 per barrel was reasonable, saying that its average price in 2007 has been $63, only $2 more than last year. If priced in euros, Iran argued, oil prices have actually fallen this year.

“King Abdullah said the same: Even $100 is less than it should be,” Iranian President Mahmoud Ahmadenijad said of current oil prices.

He was referring to Saudi Arabia’s king, whose approach to the meeting as a whole was more moderate. King Abdullah stated the purpose of opec was to protect the interests of its member states as well as the world’s economy at large, and praised them for acting in a “moderate and wise manner” (ibid.).

However, he did not disagree that oil was fairly priced.

Saudi Arabia said it would still consider increasing production, but other opec members opposed the idea, including Iran and Libya, who said current supplies were sufficient and high prices were the fault of several factors, including the sliding dollar.

The dollar has fallen 16 percent in value this year, putting a huge dent in the purchasing and investing power of opec countries that hold vast dollar reserves.

Hence, Iran and Venezuela called for opec to stop pricing oil in dollars and instead price it against a basket of currencies. Though their call for dollar worries to be included in the final draft of the summit’s official communique was denied, opec’s loss of confidence in the dollar still became fully apparent.

During the summit, representatives held a key private meeting behind closed doors, but not closed microphones. In an apparent technical blunder, the conversation was accidentally broadcast to the pressroom, and Prince Saud Al-Faisal was overheard saying, “My feeling is that the mere mention that the opec countries are studying the issue of the dollar is itself going to have an impact that endangers the interests of the countries. There will be journalists who will seize on this point, and we don’t want the dollar to collapse instead of doing something good for opec.”

Later, he said, “This is not new. We have done this in the past: decide to study something without putting down on paper that we are going to study it, so that we avoid any implication that will bring adverse effects on our countries’ finances” (ibid.).

The Financial Times reports that “a move by opec to drop the dollar would be taken in financial markets as a signal that member countries would shift their holdings of foreign exchange reserves away from the U.S. currency.”

The final communique included the goal of securing oil as an essential energy supply in the future and an environmental initiative, but did not directly mention opec dropping the dollar. However, member states have in fact agreed to have their finance ministers meet before the December 5 meeting to discuss the tumbling dollar.

Continue to watch the dollar, formerly the most powerful currency in the world by a significant margin, to fall under siege on more and more fronts. Loyalty to the failing American currency is bound to run out. As a result, expect the United States to lose political and strategic influence over world events.

The Trumpet and its predecessor, the Plain Truth, have watched the dollar closely and forecasted the economic decline of the United States and Britain. Expect the dollar to continue taking its lumps and two of the world’s most significant economies to bend to the breaking point.