China Passes U.S. in Top 10 Biggest Companies List

China is booming, and that fact has not been lost on stock market investors. For the first time ever, more of the world’s 10 largest companies are Chinese than American.

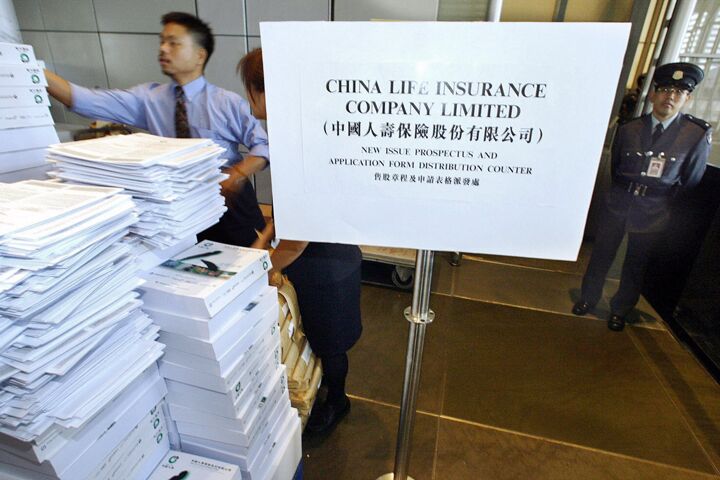

China Life Insurance Co. jumped ahead of AT&T Inc. in market value on October 29, giving China the edge on the United States. Five out of the top 10 companies are now Chinese, compared to three that are American, although U.S.-based Exxon Mobil still retains first place with a valuation of approximately $525 billion. The U.S.’s other two companies in the top 10 are General Electric and Microsoft.

Back in 1999, near the height of the technology boom, America was home to seven of the world’s top 10 companies, with two Japanese and one German company filling out the rest. In addition, America owned 14 of the top 20 companies.

According to Bloomberg, part of the reason the value of Chinese companies is growing so fast is the booming domestic stock market, which is up far more than U.S. exchanges. Some analysts feel China is a bubble ready to pop. The Chinese csi 300 Index has risen 170 percent this year. America’s Standard & Poor’s 500 Index has risen just 8.9 percent.

However, some argue there may be a good reason Chinese firms are fetching such high premiums. “China is one of the most exciting economies,” said world-renowned commodities investor Jim Rogers. “The market is willing to pay a lot more for future growth.” The gross domestic product in China grew by 11.5 percent from a year earlier in the third quarter, compared to a 3.9 percent growth rate in the U.S.

China also passed the U.S. with the number of companies in the top 20 (eight compared to seven), and now has more companies valued above $200 billion than does America. By market value, Air China Ltd. has become the world’s largest airline, and icbc bank is now the largest bank—more valuable than Citigroup or Bank of America (America’s two largest banks, ranked third and fourth in terms of the world’s banks). China also has the world’s second- and fifth-largest oil companies.

Marc Faber, an analyst who became famous when he advised clients to sell stocks one week before the 1987 Black Monday stock market crash, said the world needs to get used to China.

Dominant nations come and go. Like Britain in the 1800s, America’s financial dominance is waning. “European countries were also surprised at the beginning of the 20th century when American companies overtook European companies,” Faber said. “The world better get used to it.”

However, contrary to what many analysts predict, the next global financially dominant nation will not be China. Bible prophecy shows that the next empire, soon to replace America, will be Europe. For proof, read “New Global Trend: Dump a Dollar, Buy a Euro” and Germany and the Holy Roman Empire.