Subprime Meltdown Spreading Into the Job Sector

If the U.S. economy were Star Trek, Scotty would be yelling, “The reactor core is breached, Captain! Damage from the popping housing bubble is spreading past the secondary containment into the rest of the ship!”

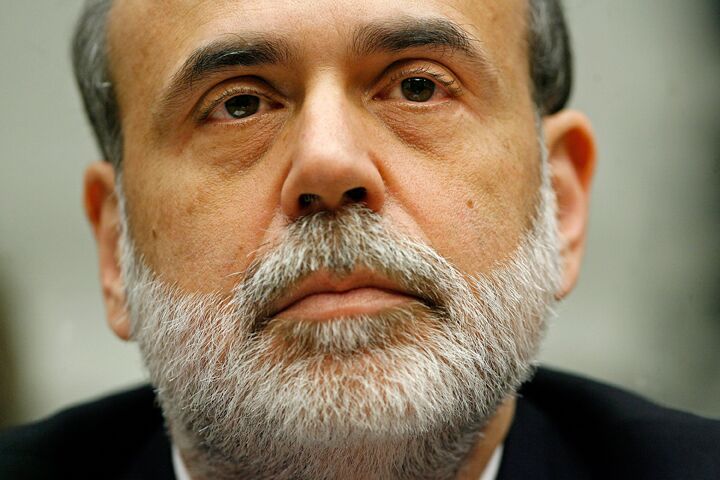

U.S. Federal Reserve Bank Chairman Ben Bernanke is dealing with a job growth reactor core that might well be going into meltdown.

Analysts originally predicted that 100,000 jobs would be created in the United States during August. As it turns out, the mainstream economic prognosticators had it wrong—big time. Instead, job rolls actually shrank by 4,000, the first decline since 2003.

“That it was down 4,000 is eye-catching,” said John Shin, an economist for Lehman Brothers. “What the payroll number confirms is that you may be seeing the damage spread across the rest of the economy.”

The sharp drop in payrolls was especially disturbing for two reasons. First, the August job losses occurred before most of last month’s financial and stock-market turbulence hit Wall Street. This means that greater job losses could be just ahead. Second, the Labor Department’s employment statistics for June and July were found to be too high and had to be revised down by 81,000. So not only does the data suggest the economy is weaker than thought, but that it has been weaker longer than previously thought.

According to the Labor Department, the manufacturing sector lost 46,000 jobs in August after falling by just 1,000 in July. Construction employment dropped by 22,000 after sliding by 14,000 positions in the previous month.

What made the report even more unnerving is that the Federal Reserve, which has continually championed the strength of the economy, was completely wrong. Ben Bernanke himself is on record for habitually saying the country’s financial problems that began this summer in the mortgage and housing industries were largely contained and would not spread.

“First, Bernanke said the subprime problem was going to remain subprime. Then … he said it was going to remain in the credit markets,” David Jones, an economic consultant based in Denver, said. “Now you’re seeing that the credit crisis has spread to Main Street.”

But employment conditions in Main Street America may worsen yet further.

On Friday, Countrywide Financial, the nation’s largest mortgage lender, announced that it was laying off 12,000 people, approximately one fifth of its work force. In a letter to employees, the company founder and ceo Angelo Mozillo blamed the cuts on the current housing market, which he said was “the most severe in the contemporary history of our industry.” He also noted that conditions may not improve any time soon, as home price appreciation had “stopped dead in its tracks,” and that there have been increasing delinquencies in “far too many borrowers.”

Mozillo expects a 25 percent drop in the number of loans issued to purchase homes in 2008, providing further evidence that more job losses in construction and lending may be ahead.

Countrywide is not alone. IndyMac Bancorp Inc., a large California-based lender, has also announced that it will cut approximately 10 percent of its lending staff.

Recession could be on the way. Judging by the recent employment statistics, it might already be here.

The extremely lousy job report is going to force policy makers in Washington to re-examine their computer models to see what is really going on in the real outside world, says John Silvia, chief economist at banking giant Wachovia Corp. “And what’s going on doesn’t look good.”

In times of financial trouble, strong leadership is needed. Federal Reserve Captain Ben Bernanke has some tough decisions ahead as the economy slows, home prices continue to fall, and job losses mount.

Fallout from the popping housing bubble and subprime mortgage crisis seems to be spreading. Are you prepared?