Selling Britain’s Corporate Crown Jewels

The battle for the world’s largest airport operator, British-owned baa, is over. After months of beating back the hostile takeover attempt by Spanish construction giant Grupo Ferrovial and bids by an American-led Goldman Sachs consortium, baa fell to the Spanish predators.

London’s Independent is calling the $19 billion deal “the most dramatic example yet of the way in which strategic UK assets are falling to overseas bidders” (Associated Press, June 7).

Many considered baa one of Britain’s crown jewels because it owns and operates airports that handle 63 percent of travelers going in and out of Britain. In Scotland, baa handles 86 percent of all air travelers and manages airports at Glasgow, Edinburgh and Aberdeen. In London, the number of air travelers through baa airports rises to 92 percent.

Besides providing jobs for thousands of employees, baa has played a strategic role facilitating the movement of goods and people into and out of Britain and around the world. In essence, baa was the keeper for the United Kingdom’s air gates.

Last year, another British airport operator, tbi, was purchased by an international consortium which included Aena, the Spanish state-owned airports group (Financial Times, June 7).

And it is not just Britain’s air gates that are being sold.

According to the Guardian, “Britain is being sold off at a rate unprecedented in modern times. If the foreign takeover bids announced or hinted at over the past few months all go through, airports, ships, banks, gas pipelines, stock exchanges, chemical plants and glass factories will fall into foreign ownership. Yet there is no debate; scarcely an eyebrow is raised. In any other country there would be uproar” (February 17, emphasis ours).

The London Times says “[b]ig British companies are falling into foreign ownership almost daily,” with few protests (June 8). It calls the sell-offs a “mass asset-stripping of the UK’s corporate infrastructure” (ibid., March 3).

“[W]ith this rate of takeover, within a generation most British workers outside the public sector will be working for foreign companies,” the Guardian reports. “The scale of what is happening is truly breathtaking compared with even five years ago” (op. cit.).

As reported by the Economist, the value of British companies purchased by foreigners doubled to a record $91 billion last year from $41 billion in 2004 (March 4). The worry is that the current rate and scale of foreign takeovers is “a sign of weakness, not strength” (Guardian, op. cit.).

A quick news search reveals a list of former British-owned corporate crown jewels that stands out like a treasure chest of sparkling gems atop a desert sand dune.

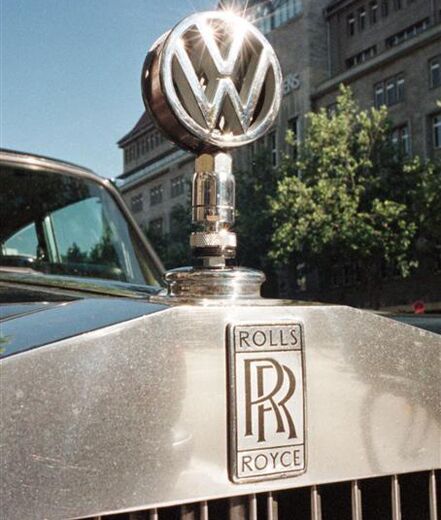

Automotive sector: Once British manufacturers, Rolls-Royce, Aston Martin, Bentley, Jaguar, and mg Rover are now all foreign owned. American companies purchased Aston Martin and Jaguar; the Chinese, mg Rover; and in a cruel irony, Rolls-Royce and Bentley were bought by German companies (Independent, April 12). bmw purchased Rolls-Royce, the company that produced the engine that powered the World War ii Spitfire fighter that was so effective in combating the German bmw-built opposition.

Gas and Electricity: Many of Britain’s largest conventional power utilities are already foreign owned. In 2002, German energy giant rwe Power bought Britain’s third-largest energy supplier, npower, which supplies electricity and gas to approximately 6 million customers. Another German energy giant, E.On, owns even more of Britain’s energy distribution system. Through its subsidiary Powergen, E.On provides power and gas to 9 million British customers, making it Britain’s second-largest electricity and gas provider. edf Energy, the French state-owned energy giant, is Britain’s fifth-largest electricity and gas provider.

Until recently, very few have even questioned the wisdom of putting the nation’s heat and electricity in the hands of foreign corporations. In commenting upon the recent proposed takeover of British utility Centrica by Russian state-owned Gazprom, Britain’s Chancellor of the Exchequer Gordon Brown warned it could raise political issues. Gazprom is the company that cut off the gas supply to Ukraine and consequently much of Europe early this year in what was seen as a political spat between the two governments. Centrica is Britain’s largest gas utility, supplying gas to 13 million homes.

Nuclear Power Generation: On February 6, British Nuclear Fuels (bnfl), the British state-owned nuclear power manufacturer, announced it had sold its power station construction arm, Westinghouse, to Japan’s Toshiba corporation. The Prospect union, which represents several thousand engineers, scientists and managers at 22 sites, attacked the sell-off for “robbing Britain of new-build expertise” (Morning Star, February 7). The government is also considering selling its stake in the nuclear power firm British Energy, which manages eight of the UK’s nuclear power stations and is the nation’s largest electricity generator.

Water: Britain’s largest water utility, Thames Water, is foreign owned, though it is up for sale once again by its German owners. Thames Water supplies water and wastewater services to millions of Britons and other customers around the globe. French-owned Veolia Water also owns and operates several UK utilities.

Telecommunications: Communications providers have also been gobbled up. Last year, O2 plc, a mobile-phone company, was sold to Spain’s Telefonica for $31.7 billion. On January 23, Marconi Corporation plc, the last remaining British telecom manufacturer of any size, was purchased by Sweden’s Ericsson. Marconi was a British institution whose roots could be traced back to 1897. It was also considered a heavyweight in the British defense industry.

Industrial manufacturers: Founded in 1886, British-owned boc Group, the world’s second-largest industrial gases group, is in the process of being purchased by a smaller German rival, Linde. This deal will make Linde the world’s foremost producer of industrial gases.

Another old imperial UK company that built parts for the Spitfire, Pilkington, was also recently taken over. The 180-year-old glass company manufactured the windows that fighter pilots used to peer through. The company has been bought by Nippon Sheet Glass, a comparatively smaller Japanese company. The merger creates the world’s largest glass manufacturer.

Shipping and Trade: Once the dominant global power in trade, today many of Britain’s ports and shipping companies no longer belong to the British. P&O (Peninsular and Oriental Steam Navigation Company), a company founded 169 years ago during Britain’s superpower days and one of the world’s largest shipping companies, having an unparalleled infrastructure of container ports and ships, was purchased in March by the United Arab Emirates state-owned company Dubai Ports World for $6.8 billion.

Finance: British banks have also been targets. In 2004, Abbey National, Britain’s sixth-largest bank and second-largest mortgage lender, was purchased by Spain’s Banco Santander for ₤9 billion (us$16.7 billion). This past May, France’s Credit Agricole sa confirmed that it was looking at another British bank, Alliance & Leicester plc, as a possible takeover target.

Even the London Stock Exchange is currently fighting off a hostile takeover attempt by Nasdaq.

Sports: It might be surprising to some, but Britain’s probably most well known, if not most adored, soccer team, Manchester United, is also foreign owned.

When it comes to protecting their own nation’s goal, are British politicians running down the field in the wrong direction?

Tomorrow we will examine why Britain is allowing this unprecedented sell-off of British businesses, and some of this trend’s larger ramifications.