Living on Triple-Crème Gourmet Government Cheese

Once upon a time, within the art-adorned walls of a lakeside mansion in Deephaven, Minnesota, there lived a lord and a lady. That’s what Colin and Andrea Chisholm often called themselves, anyway. The Chisholms’ total assets amounted to $97 million, including some $3 million in cash. The “lord and lady” spent lavishly on traveling, upscale restaurants, entertaining guests, massages, original works of art, a collection of purebred dogs and even a million-dollar yacht. In April 2011 alone, they shelled out more than $23,000 just on travel and luxury items.

But there were some expenses—like groceries and health services—which they avoided paying for. They didn’t pay for the bread and milk or the trips to the wellness center—American taxpayers did.

For more than seven years, the Chisholms lied to authorities and falsified documents about their income and home address. By the time they were caught, they had collected more than $167,420 in food stamps, cash assistance and health benefits from the state of Minnesota, and an as yet undisclosed amount from Florida. Court documents showed that they spent more than $60,000 of health assistance funds on massages and other services at an upscale spa in their hometown.

Though extreme, the Chisholm case shows how easily—and to what grandiose extent—America’s welfare system can be exploited. And every day, shocking numbers of people are misusing it.

The Big Porous Picture

The program with the lowest reported fraud levels is Temporary Assistance for Needy Families (tanf), which gives cash assistance to needy families with children. tanf fraud happens when a recipient claims to be a single parent when the other parent is actually living at home; collects assistance from multiple states; or receives payment for a child not living in the house or for a fictitious child. Reports say fraud accounts for a little less than 2 percent of tanf collections. That would mean $665 million goes to tanf scammers each year.

For unemployment benefits, the Department of Labor says that in 2011 roughly 3 percent of claims were fraudulent. That amounts to $3.3 billion—not exactly chump change. Some of it went to prisoners and dead people, with family members cashing the checks. Most of it went to individuals who were employed and earning wages. Almost half a billion dollars went to workers earning yearly wages of $46,800 or more. About $80 million went to households earning more than $1 million per year.

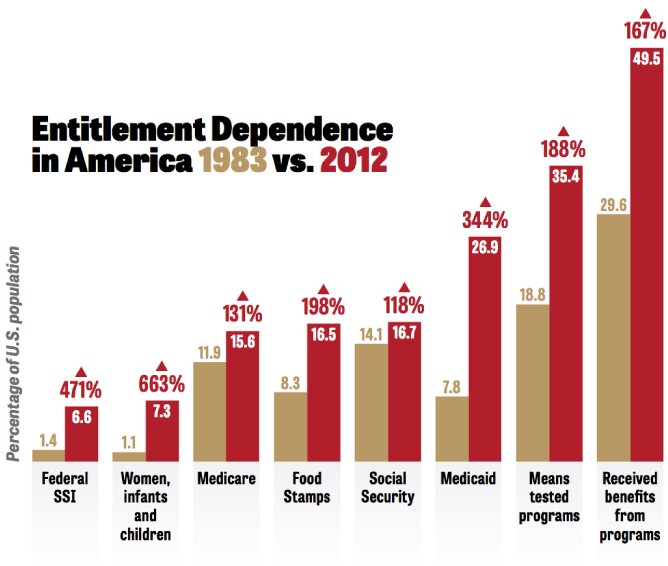

Then there is the food stamp program, which is now called the Supplemental Nutrition Assistance Program (snap). Over the last decade, participation in snap has increased dramatically. In 2013, more than 47 million Americans received snap assistance, a 70 percent increase over 2008. That year, food stamps cost taxpayers $76.4 billion. The officially reported rate of snap enrollment fraud is just over 2 percent, or $1.67 billion per year.

Supplemental Security Income (ssi) and Social Security Disability Insurance (ssdi) each shell out an estimated 10 percent of their payments toward fraudulent claims, adding another $20 billion in annual fraud.

Medicare and Medicaid both suffer massive levels of fraud. Authorities estimate that each pays out between $60 and $90 billion in “improper payments” every year. Most Medicare/Medicaid fraud is on the part of dishonest clinics or doctors who bill for procedures their patients never received or never needed. But a significant part is committed by patients.

According to these reported figures, total welfare fraud costs the U.S. about $210 billion a year, which is about 6 percent of the country’s total federal budget.

But is that the entire picture?

‘More Common Than We Think’

Some of those reported numbers are eye-popping, but the full extent of the problem is even greater than they reveal. “It’s hard to know what we don’t know,” said Jerry Kerber, the inspector general with Minnesota’s Department of Human Services. “It’s hard to know what might be going on under the radar.”

Rep. Steve Drazkowski, a Minnesota Republican, said he is convinced that fraud is “more common than we think it is.”

One act of fraud that’s as easy to commit as it is difficult to catch is food stamp trafficking. Most families enrolled in snap receive $300 to $500 per month in benefits. The program distributes these funds in the form of ebt cards. The cards look and function like debit cards, except that the allotted funds only work to buy uncooked staple foods to be eaten at home. The cards won’t allow cash withdrawals or purchase of alcohol, cigarettes, pharmaceuticals, cooked food, pet food, fuel, toiletries or anything else.

With food stamp trafficking, a person receiving food assistance offers to buy another individual’s groceries with the funds on his or her card in exchange for cash. To give the other person extra incentive, the cardholder usually offers to buy $2 worth of groceries for each dollar of cash. Many shoppers pounce on the opportunity to give the cardholder a $20 bill in exchange for $40 worth of groceries. Cash in hand, the welfare recipient now buys whatever he wants: alcohol, cigarettes, restaurant meals, recreation—all thanks to taxpayer money.

It is also common for convenience store workers to buy an entire ebt card from a welfare recipient at a fraction of the value. All ebt purchases are tax-free, so store owners can use the cards to buy food to stock their shelves tax-free. Or he can create bogus grocery purchases to channel the ebt funds into his store’s bank account. A few hundred dollars here and there adds up fast for some store owners. In 2012, brothers who owned a pair of convenience stores in Louisiana were convicted of defrauding snap of $2.7 million.

Watchdog.org says that in many parts of the country, food stamp trafficking is so prevalent that the ebt cards have become “street currency.” The trafficking is not traceable, and it is rare to catch perpetrators, so it isn’t factored into the reported fraud rates for snap.

Some feel that food stamp trafficking is justifiable: “[T]hey are stressed—because they are poor, because they are in painful life transitions,” a commenter wrote in response to an online article on welfare fraud. “I don’t begrudge such a parent a few smokes or a drink. I know that’s not the point of food stamps, but food stamps are just assets to the folks getting them. … Why should we expect poor people to live outside our cultural norms?”

Food stamp trafficking isn’t the only type of fraud that generally goes unreported. Many welfare recipients also have jobs that pay them off the books. They work as baby-sitters, house cleaners, etc. and get paid in cash. If they obeyed the law and reported their income, they would not qualify for welfare. But they don’t, so they still collect. Kerber said there is nothing “in place to go check people’s lifestyle and see whether or not their lifestyle really does match what they’re claiming in income.”

Reported fraud rates are also artificially low because many welfare programs rely almost entirely on tips to catch scammers. Agencies advertise hotlines and websites, and encourage anyone with information to report suspected fraud or abuse so that they can investigate. The trouble is, some areas are so full of people scamming the system and so dominated by anti-establishment attitudes and feelings of entitlement that reporting is scanty at best.

Government agencies also tend to downplay fraud rates. In snap, for example, the official enrollment fraud rate is 2.18 percent, or around $1.67 billion. But independent investigations always unearth higher numbers. In 2011, for example, the Washington Examiner estimated that the actual rate is 3.86 percent, which would project out to some $3 billion. Of course, snap administrators are not eager to publicize fraud; they don’t want to invite additional scrutiny or risk losing funding.

All of these figures, official or otherwise, concern actual illegal fraud. But how much completely legal opportunistic behavior do welfare programs permit and even encourage?

A Steady Diet of Government Triple-Crème Cheese

As part of the 2009 stimulus package, the federal government relaxed restrictions on able-bodied adults without dependents who seek food assistance. The change made hundreds of thousands of young singles around the nation eligible for snap for the first time, and many wasted no time signing up.

In 2010, Salon published the article “Hipsters on Food Stamps” explaining the trend: “Twenty- and 30-somethings with college degrees and foodie standards are shaking off old taboos about who should get government assistance and discovering that government benefits can indeed be used for just about anything edible, including wild-caught fish, organic asparagus and triple-crème cheese,” the article said.

The author interviewed a 30-year-old art school graduate who applied for snap after having trouble finding work in her field of study. “I’m eating better than I ever have before,” the graduate said. Among the foods she typically bought with government money: raw local honey and fresh-squeezed juices.

Salon also spoke with a 31-year-old University of Chicago graduate working part time as a blogger and collecting food stamps. “I’m sort of a foodie,” he said, “and I’m not going to do the ‘living off ramen’ thing. … I used to think that you could only get processed food and government cheese on food stamps, but it’s great that you can get anything.” Among the recent meals the blogger had prepared for himself: gourmet roasted rabbit with butter, tarragon and sweet potatoes.

Salon is strongly in favor of the trend, saying, “They’re young, they’re broke, and they pay for organic salmon with government subsidies. Got a problem with that?”

There is no problem with buying nutritious foods for people truly in need until they can return to self-sufficiency. But these programs allow and even encourage able-bodied young adults to “get anything” and to eat “better than [they] ever have before.” And they offer no incentive to try to graduate from the program. Students with no compunction about claiming government benefits could be encouraged to remain in their unemployed or underemployed situation as long as possible—living high on the hare.

Who Gets Hurt?

It is impossible to tally the full scope of the fraud, abuse and misuse in the alphabet soup of America’s 70-plus welfare programs. But it is clear that great numbers of people are scamming the system, stealing from their fellow Americans who pay for it.

All that fraud hurts the U.S. economy and taxpayers. If those hundreds of billions of dollars weren’t being illegally siphoned off each year, that money could be put to much more productive use—particularly if it were simply returned to its original owners in the form of lower taxes.

But as harmful as welfare fraud is to America’s taxpayers, it is even more injurious to the swindlers committing it, making a living off deceit and thievery.

Individuals gaming the system often believe their craftiness is getting them ahead. Some openly brag about their exploitation. “Taxpayers are the fools,” said a confessor of abuse who telephoned klbj News Radio in Austin, Texas, in 2013. “[C]an you really blame us? I get to sit around all day, visit my friends, smoke weed … and we are still going to get paid, on time every month.”

Such defrauders may feel they benefit from what they take; human nature is happy to take a free lunch. But breaking the law does not benefit them. In fact, their grifting handicaps them and makes them miserable. “Getting treasures by a lying tongue is the fleeting fantasy of those who seek death,” says Proverbs 21:6 (New King James Version). Though cheaters may believe they’re getting something for nothing, their deceit actually comes at a high cost. Lawlessness always invites problems and curses, and proves self-destructive in the end (e.g. Proverbs 10:2; 13:11; Jeremiah 17:11).

Individuals who bilk the system—suckling the teat of the nanny state when they could be building job skills, contributing to society and providing for themselves—suffer loss of self-respect, self-sufficiency and independence, peace of mind and inner joy. They turn from men into mice. They become professional parasites.

On Dec. 7, 2012, liberal New York Times columnist Nicholas Kristof offered an unexpected concession: “This is painful for a liberal to admit, but … America’s safety net can sometimes entangle people in a soul-crushing dependency. Our poverty programs do rescue many people, but other times they backfire.”

This truth would be self-evident to Bible readers: Unneeded welfare, the way the government offers it—even if taken “lawfully”—impedes character growth. Poverty programs “backfire” on scammers because they deprive them of a vital part of prosperous living: work.

God wants people to live prosperous lives. He inspired the Apostle John to write: “Beloved, I wish above all things that thou mayest prosper and be in health, even as thy soul prospereth” (3 John 2). In order to achieve prosperity—spiritually, mentally, physically, emotionally, financially—God expects everyone to work if they are able. There are around 790 Bible passages that mention work and labor. The Bible makes plain that work is a key part of developing godly character.

The epic scale of welfare fraud is also prophetically significant because it provides a glimpse of how deeply woven immorality and lawlessness are in the fabric of modern American society. The nation is suffering a broadscale breakdown of morality, strength of families, and individual responsibility. The history of such civilizations as the ancient Greeks and the Romans shows that such breakdowns bring empires to their knees. Bible prophecy makes plain that they will be a key factor in the collapse of the United States. “As a cage is full of birds, so are their houses full of deceit: therefore they are become great, and waxen rich. They are waxen fat, they shine: yea, they overpass the deeds of the wicked …. Shall I not visit for these things? saith the Lord: shall not my soul be avenged on such a nation as this?” (Jeremiah 5:27-29).

In a society that sees more and more people going the route of “Lord and Lady” Chisholm, many are left wondering what the big-picture solution to such a complex issue would be. For the answer, read “The Welfare System That Works.”