Russia and China Drive Nails Into Dollar’s Coffin

Russia’s second-largest financial institution, vtb, signed an agreement with the Bank of China on May 20 agreeing to bypass the U.S. dollar and instead pay each other in their domestic currencies. The deal was signed in the presence of Chinese President Xi Jinping and Russian President Vladimir Putin, who remarked that this was a “new historic landmark” in the $100 billion of annual trade between the two Asian powerhouse countries.

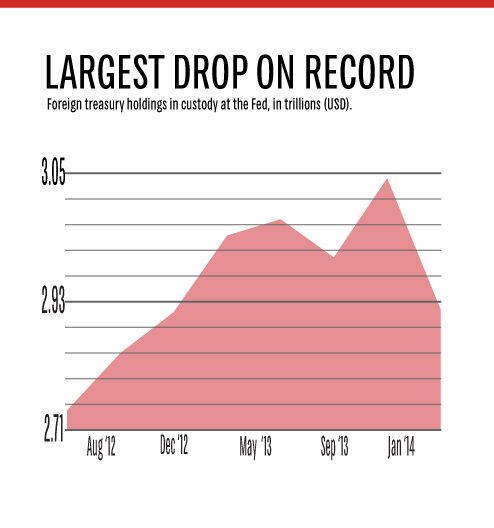

The agreement comes amidst separate reports saying Russia is dumping record amounts of U.S. treasury holdings. Between October 2013 and March of this year, Moscow’s holdings of United States treasuries fell by almost $50 billion—almost a third. Over half of that happened in March after Western nations imposed sanctions on Russia.

Then, on May 22, China announced it has halted dollar transactions with most Afghan commercial banks.

Moscow and Beijing have long desired to break the dominance of the U.S. greenback in international trade. Analysts say Washington’s punitive response to Russia’s recent aggression into eastern Ukraine—however weak it has been—is injecting new vigor into that desire. “The Ukraine crisis … may well provide the catalyst for that to start happening,” said Chris Weafer, founding partner of Macro-Advisory in Moscow.

Michael Klare, professor of peace and world security studies at Hampshire College, said, “China sees the dominance of the dollar in international trade transactions as a remnant of American global dominance, which they hope to overthrow in the years ahead. This is a small step in that direction.”

The decision of vtb and the Bank of China to begin trading in their own currencies, Moscow’s record dollar dumping, and China’s move to halt dollar trade with Afghan banks all represent nails in the coffin of the greenback. Since the U.S. has not been able to get its financial house in order, the rush of nations to abandon the greenback will gain momentum rapidly in the months and years ahead. From its earliest editions, the Trumpet has warned that the age of the dollar is coming to an end—and has explained that the greenback’s collapse is a precursor to the downfall of the United States.

To understand the significance of this trend, read our article “Russia’s Euros-for-Oil Plan Threatens Dollar’s Reserve Currency Status.”