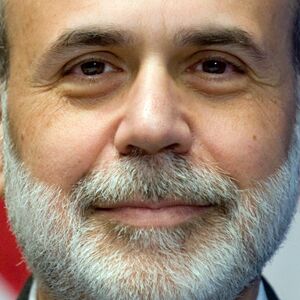

Ben Bernanke—Hero?

Check out a copy of the latest Atlantic. The cover of the April issue is a glowing picture of Federal Reserve Chairman Ben Bernanke—“the hero” who “saved the global economy.” Da-na-na-na-na-na-na-na Bernankman!

As steward of the U.S. economy, Bernanke has a few accomplishments. In 2010, the year after the great recession tenuously ended, people who made more than $356,000 (the top 1 percent of earners) saw their incomes rise by more than 11 percent. Bang! The top one hundredth of Americans saw their incomes jump by more than 21 percent. Pow! Ninety-nine percent of Americans saw their incomes rise too—by an average of $80. Zing.

So, the rich are getting richer. And the poor … can afford to eat out two more times per year.

But hey, Bernanke’s job description at the Federal Reserve isn’t to make everyone rich. His job description consists of two main heroics: Promote employment and prevent inflation.

Here’s Bernankman’s own Bernank evaluation of his performance on jobs: “After nearly two years of job gains, private payroll employment remains more than 5 million jobs below its previous peak; the jobs shortfall is even larger, of course, when increases in the size of the labor force are taken into account,” he said on Monday. “And the unemployment rate in February was still roughly 3 percentage points above its average over the 20 years preceding the recession. Moreover, a significant portion of the improvement in the labor market has reflected a decline in layoffs rather than an increase in hiring.”

In summary: Almost four years after the recession, America is still down 5 million jobs. During this time, America’s workforce has shrunk, even as the population has increased. Simply put, more people are not even trying to find work.

Right now, 46 million Americans have at least part of their food bill paid for by the government—one out of every seven. That is an increase of 14.2 million since 2008—2 million more than live in greater Los Angeles. Meanwhile, almost half of all Americans are now considered to be “low income” ($45,000 or less per year for a family of four) or are living in poverty—more than twice as many people as 10 years ago.

Bernankman’s Federal Reserve has been undeniably unheroic in its job of creating jobs—but it has been veritably villainous on inflation.

The purchasing power of the dollar speaks for itself. Since the creation of the Federal Reserve in 1913, the dollar has lost between 95 and 97 percent of its value. Bernanke has only been on the scene of the crime for the past six years, but during his time it has dropped 15 percent on the U.S. Dollar Index. As the dollar has depreciated in value, so have the savings accounts and investments of millions of Americans. Measure the dollar against any commodity and it is crashing in value. The dollar has lost so much value that President Obama recently commissioned the U.S. Mint to look into ways to make America’s coinage out of cheaper metals, but the mint can’t find any! It costs more money to buy even the most inexpensive metal and mint the pennies and nickels than the coins are worth once minted—a consequence of the depreciating value of the dollar.

Bernanke’s Federal Reserve has obviously failed at its two primary missions. And Bernankman let his recession detector run out of batteries—or something. The chairman of what is possibly the most important financial institution in the nation charged right into the most severe economic meltdown since the Great Depression—and didn’t see it coming. Zoink!

Even after the real-estate bubble popped—and everyone could see it—Bernankman still had the audacity to say that the housing market going down in flames was basically under control and that the subprime market was contained. Less than five months before the recession he touted the strong economy and strong global economy.

Then—bam!

Four years after the crash, here is what Bernanke told the Atlantic he learned from it all: “Everyone failed to appreciate that our sophisticated, hypermodern, highly hedged, derivatives-based financial system—how ultimately fragile it really was.”

Right. Besides the fact that lots of people, including the Trumpet, were blaring warning sirens, what has the heroic Bernankman done since? Has he really learned a lesson?

Nothing has changed. Except that a few new regulatory agencies have been created. Nothing fundamental has been fixed. There were regulators before the crash too, and they also failed at their missions. And why would any small-time regulator try to go against the tide and try to prevent the crash when the biggest regulator of them all, the Federal Reserve, not only wasn’t saying anything, but was actively fueling the bubble?

As analyst Mike Shedlock asks, “[W]hy should any credit be given [to Bernanke] when we can say without a doubt the Fed caused the global economic crisis in the first place?”

So where are we today, four years into Bernankman’s heroic protection of our financial city?

Out of thin air, Bernanke has created and spent trillions of dollars to “prop up” and “stimulate” various aspects of the economy. The U.S. federal government, not to be outdone, has borrowed and spent trillions more. They have doubled down on more of the exact same things that caused the economic crisis in the first place.

The result? A slight economic bounce: some transient jobs and industries that won’t necessarily last. With a price tag of trillions in new debt.

We are right back where we began. Right where we were before the crisis.

We still have the same dangerous “too big to fail” banks with leveraged balance sheets. In fact, they’re even bigger than they were before the bailouts. We still have a market over-supplied with houses and under-supplied with jobs. We have students graduating with record amounts of debt who earn lower real, inflation-adjusted salaries than their parents. We have a trade deficit that is expanding again as we import more than we export. We have a government facing a new record $15.5 trillion debt. We have an additional $20,000 debt per man, woman and child. We have a budget deficit that the Congressional Budget Office says will be $100 billion higher than expected. We have a government that has promised another $61 trillion—money we don’t have—to Medicare, Medicaid and Social Security baby boomers who are now starting to retire.

Plus, America may now have a Federal Reserve and a currency facing a credibility issue due to all that fiat money creation.

Kapow!

We still owe the trillions we owed before the disaster. We owe trillions for our failed attempts at fixing the disaster, and we are plunging into a multimillion-person deficit of confidence in the system that is going to be terminal. We have a mass media trying to convince us that villains are heroes and that the global economy has been saved. And we have millions of people who gullibly eat it up.

Nothing has been fixed, and the system is getting ready to fail again.

If we are going to fix the real problems, we need something different than any superhero, real or imagined, can deliver. Let’s start by doing away with wishful thinking and start facing reality.