UK to Opt Out of 100 EU Laws

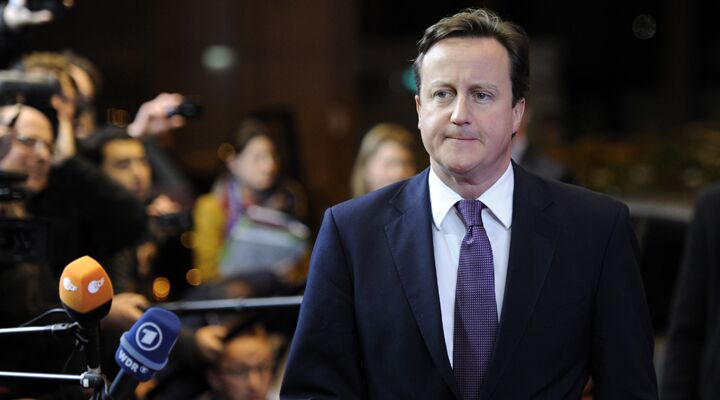

Britain will opt out of over 100 European Union laws on policing and crime, the Sunday Times reported September 23, claiming that Prime Minister David Cameron is preparing to announce the opt outs shortly.

The announcement would see Britain reverse key steps toward European integration, while Europe’s leaders loudly call for “a federation” and “more Europe.”

The most high-profile law facing the axe is the European Arrest Warrant (eaw), which requires a member state to hand over someone suspected of a crime in another. Once an eaw has been issued, there is very little Britain can do to avoid handing the suspect over, even if the suspect is a British citizen, and even if he is accused of an offense that isn’t a crime in Britain.

This law is unpopular with both the left and right, especially after it was used to compel Britain to attempt to hand over WikiLeaks founder Julian Assange to Sweden. Some have been held without charge in terrible conditions in foreign jails for months. In one of the most outrageous cases, Portugal issued an eaw for a man charged with first degree murder, despite the fact that he was acquitted on similar charges years earlier, and that the man he supposedly murdered was still alive. In this case, the warrant wasn’t fulfilled.

Under the Lisbon Treaty, Britain can opt out of all of the 130 of the laws on crime and justice. Afterward, it can negotiate with the EU to opt in to certain laws. The Times claimed that a “senior government source” confirmed that the government planned on opting in to “dozens” of the laws. It reports that these laws are probably the ones on human trafficking and smuggling—where international cooperation is more useful.

“This is a fork in the road for the British justice system, and a vital opportunity to retain UK democratic control over criminal justice policy,” said Conservative Member of Parliament Dominic Raab.

It’s also a fork in the road for Britain and Europe. If this goes through, it would be an actual, concrete step away from European integration, not just the disgruntled chattered that is a constant part of British politics. Meanwhile, core European nations are looking for ways to bind themselves closer together with more laws. As the Trumpet has forecast for years, Europe is heading toward a federation, and Britain is heading out.