Britain: Repossessions Up 40 Percent

The number of people losing their homes for failing to make their mortgage payments rose over 40 percent in the United Kingdom during the first half of this year. Repossessions are now at their highest level in over a decade. The number of households that are over three months late on their mortgage payments rose from 129,600 at the end of 2007 to 155,600, making up 1.33 percent of all mortgages.

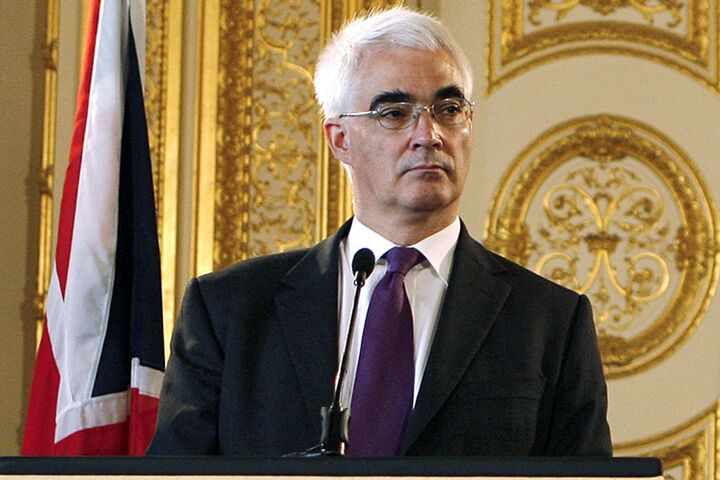

British Chancellor of the Exchequer Alistair Darling admitted that the slowdown could be “pretty dramatic.”

According to Peter Williams, executive director of the Intermediary Mortgage Lenders Association, “Homeowners have borrowed the maximum mortgage possible and, in some cases, may have over-extended themselves with unsecured debt.”

Too many homeowners believed the continued increase in property values would give them an endless fountain of wealth. Television ads told viewers to “unlock the value” in their homes by re-mortgaging once their house increased in value. Banks granted 100 percent or even 110 percent mortgages. Now that house prices are falling, people are waking up from their dreamland. Money does not grow on the trees in your front yard after all.

No system with so much debt can stand. Sometime in the near future it must all unravel. Then, repossessions will be measured in hundreds of thousands. For more information, read “The Coming Storm.”